Mandatory Provident Fund

FAQ

After submitting the application form with all supporting documents, an employer will receive a Notice of Participation within 30 days. We will report employer’s participation details to MPFA.

Yes. Mandatory contributions to be paid to an employee for a certain contribution period are based on the income of the employee during that period. If the income of the employee fluctuates between different contribution periods, then the mandatory contributions will fluctuate correspondingly.

Under the Mandatory Provident Fund Schemes Ordinance (“MPFSO”), it is the employer's responsibility to ensure the calculations of the income and contributions of an employee are accurate.

Yes. Under the MPFA’s Guidelines, relevant income includes wages, salary, leave pay, fee, commission, bonus, gratuity, perquisite or allowance, paid by an employer directly or indirectly to an employee under a contract.

According to the MPFSO, the employer is required to provide a monthly pay-record to each employee within seven working days after the mandatory contribution is made. Information in the pay-record should include the employee's relevant income, the amount of contributions made and the date the contributions were paid to the scheme.

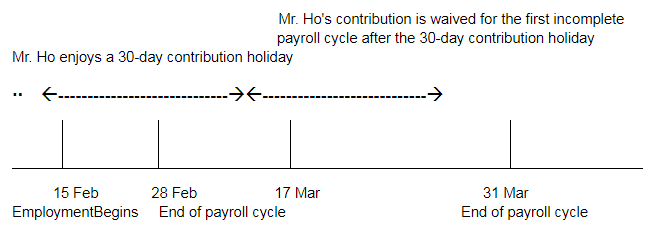

For NEW employees with monthly or more-frequent payroll cycles, e.g., weekly or bi-monthly, the employee’s contribution for the first incomplete payroll cycle immediately following the 30-day contribution holiday will be waived. Employer’s contributions will continue to start from the first day of the employment.

Example: Mr. Ho begins his employment on 15 Feb 2003 with a monthly payroll cycle. Mr. Ho can enjoy a 30-day contribution holiday (i.e., from Feb 15 to Mar 16) and he does not need to make any contribution for the first incomplete payroll cycle (i.e., Mar 17 to Mar 31) immediately following the 30-day contribution holiday. Hence, Mr. Ho starts his contribution on 01 April 2003.

Yes. An employer has the right to switch to another MPF scheme and transfer the accrued benefits of its employees into that scheme. To start the transfer process, the employer should simply provide a written notice to the trustee of the new scheme. Upon receipt of the application, the new trustee will complete the transfer from the existing trustee.

When an employee ceases employment, the employer must give a written notice to the trustee of the scheme concerned no later than the 10th day after the month in which the employee concerned ceases employment. The employer may use the remittance statement to inform the trustee of the employee's cessation of employment and the date of cessation.

According to the MPFSO, an employer must submit the contributions to the trustee within 10 days after the end of the contribution period. If an employer cannot make the contribution on time, a surcharge will be incurred. The following is the calculation of the surcharge:

Surcharge = Total Contribution (Employer + Employee) X 5%

When handling MPF contributions, you should be mindful of the misconceptions to avoid your payment being considered late or default.

The minimum level of the relevant income for MPF contributions was revised from HK$6,500 to HK$7,100, effective on 1 November 2013. As a result of the amendment, for contribution periods starting on or after 1 November 2013, employees with a monthly relevant income less than HK$7,100 will not be required to make their part of contribution, but their employers will have to continue making the employer’s part of contribution. Self-employed persons with relevant income less than HK$7,100 monthly or HK$85,200 yearly do not have to make contributions. Please note that if you are not required to make mandatory contributions as an employee or self-employed person by reason of this amendment, you may still choose to make voluntary contributions.

For contribution periods commencing on or after 1 June 2014, the maximum level of the relevant income for MPF contributions of monthly paid regular employees and their employers was amended from HK$25,000 to HK$30,000. As a result of the amendment, the maximum contributions will be adjusted from $1,250 to $1,500 monthly accordingly.

There are 3 ways to submit contribution payments:

(a) By Cheque: Employers can send the cheque together with the Remittance Statement by post to us directly before the end of the 10th calendar day. All cheques must be made payable to "YF Life Trustees Limited".

(b) By Direct Deposit: Employers can remit the amount stated in the "Remittance Statement" to our following accounts:

(1) HSBC: 004-500-674296-001

(2) Bank of China: 012-875-0-042745-6

Please forward the bank-in slip together with the Remittance Statement to us by mail or fax at 2919-9233 before the end of the 10th calendar day.

(c) By Autopay: A "Direct Debit Authorization Form" should be completed in order to effect the authorization. Please note that about 6 weeks' processing time is required to process a direct debit authorization application. Once the direct debit authorization application is approved, you simply need to send us your completed Remittance Statements by mail or fax at 2919-9233 before the end of the 10th calendar day.

An employer is bound by the Employment Ordinance to pay SP/LSP to an employee where applicable. After paying the SP/LSP, you can apply to your scheme trustee to withdraw the relevant amount from the accrued benefits derived from the mandatory contributions (and voluntary contributions, if any) to offset the SP/LSP. The SP/LSP will be firstly offset by the accrued benefits derived from the vested portion of employer’s voluntary contribution, if any, followed by the accrued benefits derived from the employer’s mandatory contribution.