Own your future — with gilt-edged protections

TaxVantage Prestige Medical Plan*, a comprehensive medical insurance solution second to none, provides full reimbursement of the actual expenses incurred before, during, and after your in-hospital treatment throughout Asia^, giving you peace-of-mind protection with no itemized benefit sublimit. You are also entitled to hospital stays in a standard semi-private room or standard private room (depending on confinement location), full cover for non-surgical cancer treatment and extended benefits during hospitalization and beyond.

Best of all, your qualifying premiums paid are tax deductible.

- Full reimbursement of the actual expenses incurred during your in-hospital treatment, due to sickness or accident

- Without any limit on individual benefit items for major medical expenses

- Offers a wide range of extra benefits as well as worldwide emergency treatment

- You can enjoy a lifetime benefit limit of up to HK$40,000,000 with an annual benefit limit as much as HK$10,000,000

- The plan covers unknown pre-existing conditions of the Insured Person at the time of taking up the plan

- Without any waiting period, which is much better than the minimum requirement of 3-year waiting period under the VHIS plans

- 4 Options: HK$0 / 15,000 / 30,000 / 100,000

- The higher the deductible, the lower the premium

- May change to a lower Annual Deductible before the policy anniversaries on or after your 50th, 55th, 60th, 65th, 70th, 75th, 80th or 85th birthday1 without having to submit any satisfactory proof of insurability

Notes:

1. Request for reduction of the Deductible must be submitted in writing within 30 days before the policy anniversary on or immediately following the 50th, 55th, 60th, 65th, 70th, 75th, 80th or 85th birthday of the Insured Person. This right can be exercised once only and is irrevocable. Claims in respect of a Disability occurring after reduction of the Deductible shall be subject to the reduced Deductible.

- Up to 15% provided that the policy has been in force and no claims have been made for at least three consecutive policy years

- You are guaranteed the right to renew your plan up to the age of 100, even if you experience changes to your health

- Your renewal premium2 will not be individually raised for any claim you have made, or any changes in your health condition

Notes:

2. A written notice will be given no less than 30 days prior to each policy anniversary date regarding the adjustment of benefit coverage or premium.

- Qualifying premium paid for your TaxVantage Prestige Medical Plan are tax deductible. You may also include any premiums paid into your family members’ policies when claiming a tax deduction

- For details of the tax deduction arrangement, please refer to the VHIS website of the government of the HKSAR at www.vhis.gov.hk/en/consumer_corner/tax-deduction.html

- You’re entitled to receive a free estimate of the claimable amount3 for any potential treatment or procedure before committing to it

Notes:

3. The Policy Holder shall provide the Company with the estimated fees to be incurred as furnished by the Hospital and/or attending Registered Medical Practitioner. The estimate is for reference only, and the actual amount claimable shall be subject to the final expenses as evidenced.

*YF Life Insurance International Limited is registered as a provider for the Voluntary Health Insurance Scheme (VHIS), implemented by the government of the HKSAR (registration number 00025, effective on March 6, 2019).

^Unless otherwise specified, benefits for non-Emergency Treatment shall be applicable in Asia, and benefits for Emergency Treatment shall be applicable worldwide.

Age 0-80

To Age 100

To Age 100

Other Voluntary Health Insurance Scheme Products

You may also be interested in

TaxVantage Prestige Medical Plan (Flexi Plan), TaxVantage Plus Medical Plan (Flexi Plan) and TaxVantage Medical Plan (Standard Plan) are available for your selection.

TaxVantage Medical Plan is a Standard Plan while TaxVantage Plus Medical Plan and TaxVantage Prestige Medical Plan are Flexi Plans under the Voluntary Health Insurance Scheme (VHIS) implemented by the government of the HKSAR. The coverage under the VHIS Standard Plan includes basic protection; while the Flexi Plan provides enhanced protection, e.g. higher benefit amount, extra medical coverage and a variety of product choices. Details are as follows:

|

TaxVantage Medical Plan (Standard Plan) |

TaxVantage Plus Medical Plan (Flexi Plan) |

TaxVantage Prestige Medical Plan (Flexi Plan) |

|

|---|---|---|---|

|

Guaranteed renewals for life |

√ |

√ |

√ |

|

No lifetime benefit limit |

√ |

√ |

|

|

Tax deductible |

√ |

√ |

√ |

|

Geographical coverage |

Worldwide (psychiatric treatments: Hong Kong only) |

Worldwide (psychiatric treatments and renal dialysis treatments as a day patient: Hong Kong only) |

Non-emergency treatment: Asia Emergency treatment: Worldwide (psychiatric treatments and room level downgrade cash benefit in Hong Kong: Hong Kong only) |

|

Coverage of unknown pre-existing conditions |

√ (with waiting period) |

√ (without waiting period) |

√ (without waiting period) |

|

No claim premium discount |

√ |

√ |

|

|

Choice of plan level |

√ |

||

|

Choice of deductible |

√ |

||

|

Optional extra major medical benefit |

√ |

||

|

No restriction to the choice of healthcare service provider |

√ |

√ |

√ (room level downgrade cash benefit in Hong Kong: private Hospital in Hong Kong only) |

|

No restriction to the choice of ward class |

√ |

√ |

|

|

Actual medical expenses covered and reimbursed by the plan include: |

|||

|

(I) Basic benefits |

|||

|

Hospitalization and surgery fees |

√ |

√ |

√ |

|

Day case procedure |

√ |

√ |

√ |

|

Pre- and post-confinement / day case procedure outpatient care |

√ |

√ |

√ |

|

Prescribed diagnostic imaging tests |

√ |

√ |

√ |

|

Prescribed non-surgical cancer treatments |

√ |

√ |

√ |

|

Psychiatric treatments |

√ |

√ |

√ |

|

(II) Enhanced benefits |

|||

|

Private nurse's fee |

√ |

||

|

Home nursing |

√ |

√ |

|

|

Hospital companion bed |

√ |

||

|

Renal dialysis |

√ |

√ |

|

|

Reconstructive surgery benefit |

√ |

||

|

Pregnancy complications benefit |

√ |

||

|

Medical appliances |

√ |

√ |

√ |

|

Transplantation surgery expenses for Living Donor |

√ |

||

|

Rehabilitation Centre and related treatment |

√ |

||

|

Ancillary service |

√ |

||

|

Hospice care |

√ |

||

|

Emergency outpatient treatment benefit |

√ |

||

|

Emergency dental benefit |

√ |

||

|

(III) Other benefits |

|||

|

Day surgery cash benefit |

√ |

||

|

Room level downgrade cash benefit in Hong Kong |

√ |

||

|

Additional benefit for accident |

√ |

||

|

Medical negligence benefit |

√ |

√ |

|

|

Death benefit |

√ |

√ |

√ |

|

Supplementary services / benefits (Non-tax deductible) |

|||

|

Optional extra services (without extra charges) |

|||

|

MediCare Concierge Services |

√ |

||

|

Estimate of the claimable amount |

√ |

√ |

√ |

|

Cashless Hospitalization Service |

√ |

||

|

Worldwide Emergency Assistance Benefits |

√ |

√ |

√ |

|

Optional supplementary benefits |

|||

|

Extra Cancer Benefit |

√ |

||

|

Hospital Income Benefit |

√ |

||

Please refer to the product brochures for further details and exclusions of the above features.

If you have signed up for a Standard Plan policy, the Company will offer the Standard Plan for renewal on the Policy Anniversary Date by default. You are also allowed to choose our Flexi Plan as an additional option for renewal. However, any upgrade of benefit to Flexi Plan requires your application to go through the underwriting process.

On the other hand, if you have signed up for a Flexi Plan policy, the Company will offer the same plan level of Flexi Plan for renewal on the Policy Anniversary Date by default. If you are not willing to accept the Flexi Plan offered for renewal you are allowed to choose our Standard Plan as the fall-back renewal option. You should raise any such request well before the renewal date.

Premiums paid by a Hong Kong citizen for himself/herself and his/her specified dependant(s) for TaxVantage Prestige Medical Plan, TaxVantage Plus Medical Plan and/or TaxVantage Medical Plan on or after April 1, 2019 are qualified for a tax deduction. Premiums paid can be claimed for tax deduction up to HK$8,000 per Insured Person per year. For details of the tax deduction arrangement and illustrative examples, please refer to the website of VHIS at https://www.vhis.gov.hk/en/consumer_corner/tax-deduction.html and the website of the Inland Revenue Department.

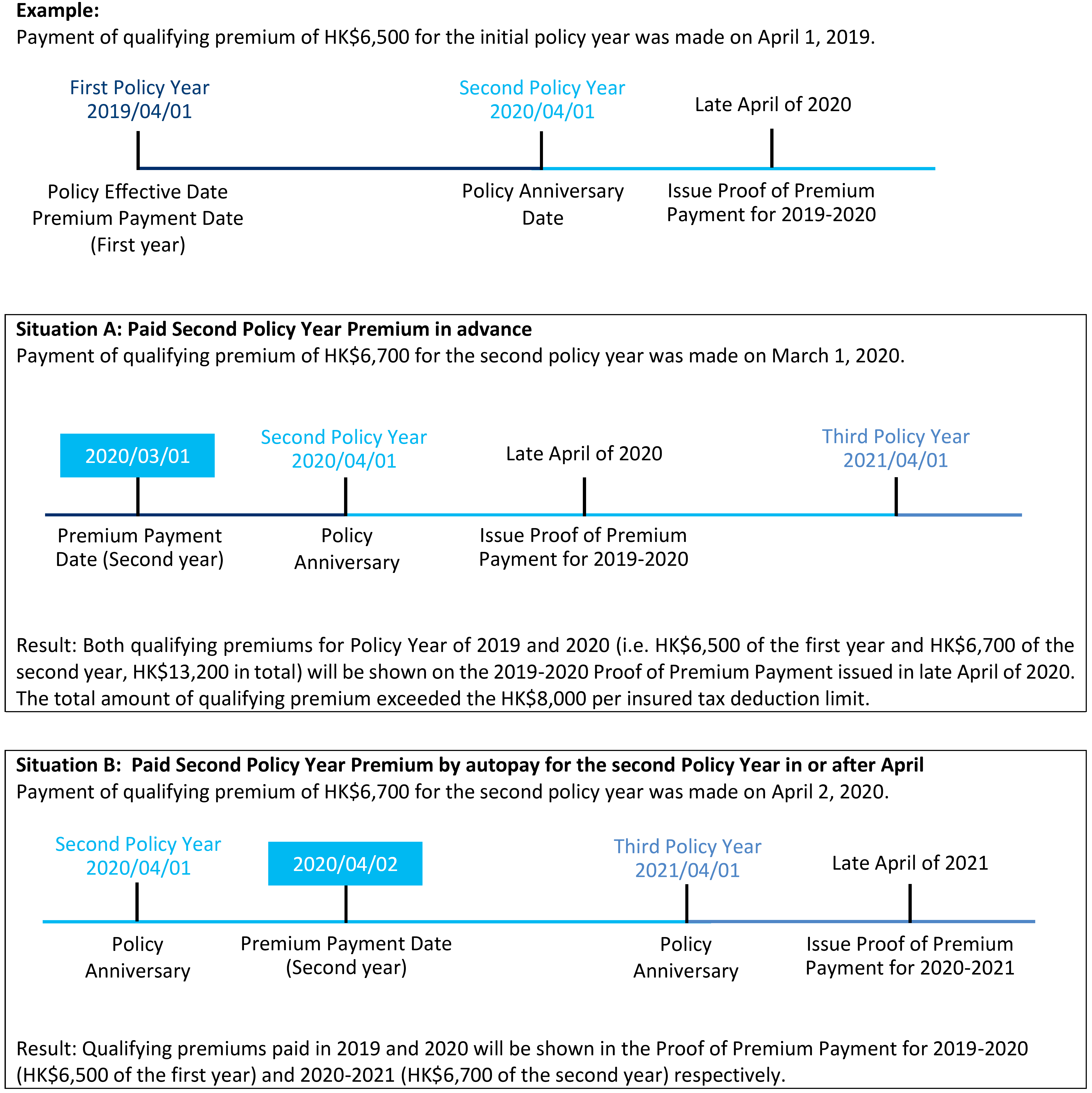

No. You should claim tax deduction in respect of the premiums paid in that year of assessment.

Since you paid the qualifying premium on March 1, 2020 (i.e. in the 2019/2020 assessment year) instead of in the 2020/2021 assessment year, you may claim the tax deduction for the 2019/2020 assessment year. To be eligible for tax deduction claim under 2020/2021 tax assessment year, the premium must be paid on or after April 1, 2020.

The detailed interpretation of the VHIS qualifying premium can be found in the Inland Revenue Ordinance (Cap. 112). According to the Inland Revenue Ordinance, the net premium for VHIS in every year of tax assessment paid by the policyholder, i.e., excluding the premium for supplementary benefits, levy and premium discount, will be treated as qualifying premium. Proof of Premium Payment will then be issued for the purposes of tax deduction.

|

Qualified Plans for Tax Deduction |

Unqualified Plan / Items |

|---|---|

|

✔ TaxVantage Prestige Medical Plan (TVPR) |

✖ Supplementary Extra Cancer Benefit (ECBV) |

|

✔ TaxVantage Plus Medical Plan (TVP) |

✖ Supplementary Hospital Income Benefit (HIV) |

|

✔ TaxVantage Medical Plan (TVM) |

✖ Levy |

|

✖ Premium Discount Promotion |

|

|

✖ No Claim Premium Discount |

Customers may make enquiries and lodge complaints directly with us via our customer service hotline at 2533 5555, or through the following channels:

(a) Voluntary Health Insurance Scheme (VHIS) Office implemented by the government of the HKSAR (for issues specific to the VHIS, including product availability, features of Certified Plans and compliance with the Code of Practice for Insurance Companies under the Ambit of the Voluntary Health Insurance Scheme);

(b) Insurance Authority (for issues concerning the general conduct of insurance companies and intermediaries); and

(c) Inland Revenue Department (for issues concerning claims for tax deduction).

Before a dispute is referred to a Hong Kong court, customers may use alternative means of dispute resolution, including but not limited to mediation and adjudication through the Insurance Complaints Bureau, or other means of mediation and arbitration as mutually agreed between Policy Holders and Companies.

The "TaxVantage Prestige Medical Plan" provides comprehensive and quality medical services with no itemized benefit sublimits. Policy owners are entitled to hospital stays in a standard semi-private or standard private room (depending on the location of confinement), full coverage for non-surgical cancer treatments, and extended benefits before hospitalization and beyond. The plan also covers unknown pre-existing conditions suffered by the Insured Person at the time of taking up the plan, without any waiting period.

Under the plan, the Insured Person can enjoy a lifetime benefit limit of up to HK$40,000,000 with an annual benefit limit of HK$10,000,000. A “no claim premium discount” up to a maximum of 15%, will be offered upon paying the renewal premium, provided that the policy has been in force and no claims have been made for at least three consecutive policy years.

- If the Insured Person is hospitalized in Hong Kong, Australia, New Zealand, or outside Asia for emergency treatment, the covered room level will be a standard semi-private room, if being hospitalized in a standard private room, the plan will incorporate an adjustment factor, thus a 50% reimbursement will be provided.

- If the Insured Person is hospitalized in Asia (except Hong Kong, Australia, and New Zealand), the room level covered will be a standard private room.

- If being hospitalized in a room level above the standard private room, the plan will incorporate an adjustment factor, thus a 25% reimbursement will be provided.

"TaxVantage Prestige Medical Plan" offers four deductible options: HK$0, HK$15,000, HK$30,000 and HK$100,000. You can choose the deductible option that best suits your needs and preferences.

Deductible refers to the eligible expenses that the insured is responsible for paying when lodging a claim with YF Life. After deducting the deductible amount, the remaining medical costs will be reimbursed, subject to the coverage scope and maximum limits of the insurance plan.

By incorporating an annual deductible, policy owners can reduce the premium costs associated with the "TaxVantage Prestige Medical Plan." The higher the deductible, the lower the premium. Any protection gap resulting from the deductible can be entirely or partially offset by the benefits from a group medical plan.