FAQ

1) What is Voluntary Health Insurance Scheme (VHIS)?

VHIS is an individual indemnity hospital insurance scheme implemented by the government of the HKSAR to provide an additional choice of health care services to the public through hospital insurance. Participation of the scheme is voluntary. Tax deduction is eligible for consumers who purchase VHIS plans.

2) What kind of insurance products are covered by VHIS?

VHIS covers insurance products that provide hospital insurance protection of indemnity nature bought by individuals for themselves and their families. It will reimburse the actual expenses for various healthcare services.

3) What are the plan options under VHIS?

There are two types of plans for selection under VHIS – Standard Plan and Flexi Plan. Standard Plan provides standardized basic protection according to the minimum requirements set by the Government. Flexi Plan provides enhanced protection such as better benefit limits and coverage.

4) What are the VHIS Certified Plans offered by YF Life available for selection?

TaxVantage Prestige Medical Plan (Flexi Plan), TaxVantage Plus Medical Plan (Flexi Plan) and TaxVantage Medical Plan (Standard Plan) are available for your selection.

5) What are the differences among TaxVantage Prestige Medical Plan (Flexi Plan), TaxVantage Plus Medical Plan (Flexi Plan) and TaxVantage Medical Plan (Standard Plan) offered by YF Life?

TaxVantage Medical Plan is a Standard Plan while TaxVantage Plus Medical Plan and TaxVantage Prestige Medical Plan are Flexi Plans under the Voluntary Health Insurance Scheme (VHIS) implemented by the government of the HKSAR. The coverage under the VHIS Standard Plan includes basic protection; while the Flexi Plan provides enhanced protection, e.g. higher benefit amount, extra medical coverage and a variety of product choices. Details are as follows:

|

TaxVantage Medical Plan (Standard Plan) |

TaxVantage Plus Medical Plan (Flexi Plan) |

TaxVantage Prestige Medical Plan (Flexi Plan) |

|

|---|---|---|---|

|

Guaranteed renewals for life |

√ |

√ |

√ |

|

No lifetime benefit limit |

√ |

√ |

|

|

Tax deductible |

√ |

√ |

√ |

|

Geographical coverage |

Worldwide (psychiatric treatments: Hong Kong only) |

Worldwide (psychiatric treatments and renal dialysis treatments as a day patient: Hong Kong only) |

Non-emergency treatment: Asia Emergency treatment: Worldwide (psychiatric treatments and room level downgrade cash benefit in Hong Kong: Hong Kong only) |

|

Coverage of unknown pre-existing conditions |

√ (with waiting period) |

√ (without waiting period) |

√ (without waiting period) |

|

No claim premium discount |

√ |

√ |

|

|

Choice of plan level |

√ |

||

|

Choice of deductible |

√ |

||

|

Optional extra major medical benefit |

√ |

||

|

No restriction to the choice of healthcare service provider |

√ |

√ |

√ (room level downgrade cash benefit in Hong Kong: private Hospital in Hong Kong only) |

|

No restriction to the choice of ward class |

√ |

√ |

|

|

Actual medical expenses covered and reimbursed by the plan include: |

|||

|

(I) Basic benefits |

|||

|

Hospitalization and surgery fees |

√ |

√ |

√ |

|

Day case procedure |

√ |

√ |

√ |

|

Pre- and post-confinement / day case procedure outpatient care |

√ |

√ |

√ |

|

Prescribed diagnostic imaging tests |

√ |

√ |

√ |

|

Prescribed non-surgical cancer treatments |

√ |

√ |

√ |

|

Psychiatric treatments |

√ |

√ |

√ |

|

(II) Enhanced benefits |

|||

|

Private nurse's fee |

√ |

||

|

Home nursing |

√ |

√ |

|

|

Hospital companion bed |

√ |

||

|

Renal dialysis |

√ |

√ |

|

|

Reconstructive surgery benefit |

√ |

||

|

Pregnancy complications benefit |

√ |

||

|

Medical appliances |

√ |

√ |

√ |

|

Transplantation surgery expenses for Living Donor |

√ |

||

|

Rehabilitation Centre and related treatment |

√ |

||

|

Ancillary service |

√ |

||

|

Hospice care |

√ |

||

|

Emergency outpatient treatment benefit |

√ |

||

|

Emergency dental benefit |

√ |

||

|

(III) Other benefits |

|||

|

Day surgery cash benefit |

√ |

||

|

Room level downgrade cash benefit in Hong Kong |

√ |

||

|

Additional benefit for accident |

√ |

||

|

Medical negligence benefit |

√ |

√ |

|

|

Death benefit |

√ |

√ |

√ |

|

Supplementary services / benefits (Non-tax deductible) |

|||

|

Optional extra services (without extra charges) |

|||

|

MediCare Concierge Services |

√ |

||

|

Estimate of the claimable amount |

√ |

√ |

√ |

|

Cashless Hospitalization Service |

√ |

||

|

Worldwide Emergency Assistance Benefits |

√ |

√ |

√ |

|

Optional supplementary benefits |

|||

|

Extra Cancer Benefit |

√ |

||

|

Hospital Income Benefit |

√ |

||

Please refer to the product brochures for further details and exclusions of the above features.

6) Can I change my VHIS benefit?

Yes. Any such change would take effect on the Policy Anniversary Date. You should raise such a request well before the Policy Anniversary Date.

7) What is the policy renewal process for my VHIS policy at the policy anniversary?

If you have signed up for a Standard Plan policy, the Company will offer the Standard Plan for renewal on the Policy Anniversary Date by default. You are also allowed to choose our Flexi Plan as an additional option for renewal. However, any upgrade of benefit to Flexi Plan requires your application to go through the underwriting process.

On the other hand, if you have signed up for a Flexi Plan policy, the Company will offer the same plan level of Flexi Plan for renewal on the Policy Anniversary Date by default. If you are not willing to accept the Flexi Plan offered for renewal you are allowed to choose our Standard Plan as the fall-back renewal option. You should raise any such request well before the renewal date.

8) Are TaxVantage Prestige Medical Plan, TaxVantage Plus Medical Plan and TaxVantage Medical Plan eligible for tax deduction?

Premiums paid by a Hong Kong citizen for himself/herself and his/her specified dependant(s) for TaxVantage Prestige Medical Plan, TaxVantage Plus Medical Plan and/or TaxVantage Medical Plan on or after April 1, 2019 are qualified for a tax deduction. Premiums paid can be claimed for tax deduction up to HK$8,000 per Insured Person per year. For details of the tax deduction arrangement and illustrative examples, please refer to the website of VHIS at https://www.vhis.gov.hk/en/consumer_corner/tax-deduction.html and the website of the Inland Revenue Department.

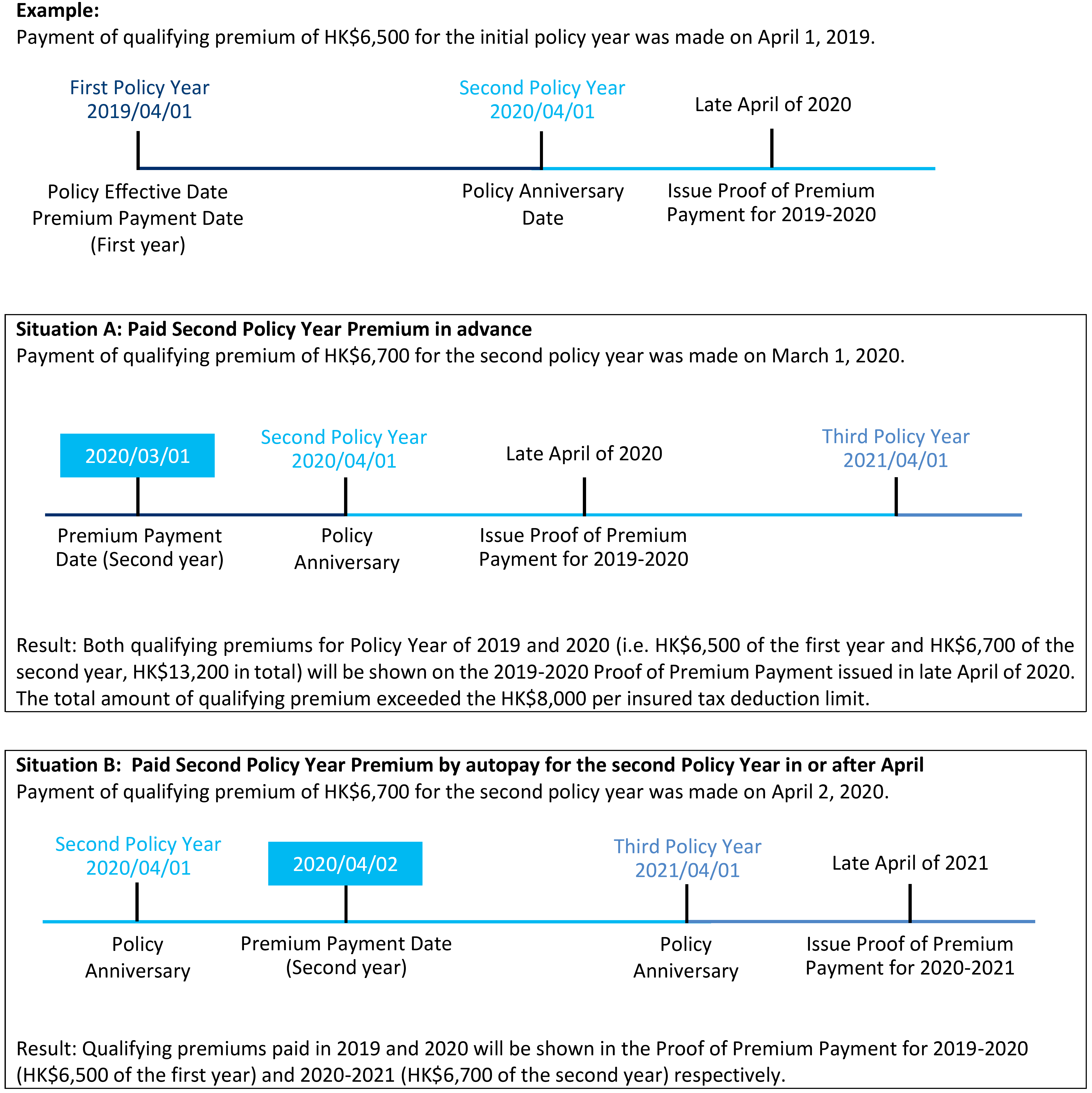

9) I have a VHIS plan with effective date as April 1, 2019. On February 25, 2020, I received a Premium Notice for the premium due on April 1, 2020. I paid the due premium on March 1, 2020 in advance. Can I make tax deduction claim for that qualifying premium paid in the 2020/2021 year of tax assessment?

No. You should claim tax deduction in respect of the premiums paid in that year of assessment.

Since you paid the qualifying premium on March 1, 2020 (i.e. in the 2019/2020 assessment year) instead of in the 2020/2021 assessment year, you may claim the tax deduction for the 2019/2020 assessment year. To be eligible for tax deduction claim under 2020/2021 tax assessment year, the premium must be paid on or after April 1, 2020.

10) What is qualifying premium?

The detailed interpretation of the VHIS qualifying premium can be found in the Inland Revenue Ordinance (Cap. 112). According to the Inland Revenue Ordinance, the net premium for VHIS in every year of tax assessment paid by the policyholder, i.e., excluding the premium for supplementary benefits, levy and premium discount, will be treated as qualifying premium. Proof of Premium Payment will then be issued for the purposes of tax deduction.

|

Qualified Plans for Tax Deduction |

Unqualified Plan / Items |

|---|---|

|

✔ TaxVantage Prestige Medical Plan (TVPR) |

✖ Supplementary Extra Cancer Benefit (ECBV) |

|

✔ TaxVantage Plus Medical Plan (TVP) |

✖ Supplementary Hospital Income Benefit (HIV) |

|

✔ TaxVantage Medical Plan (TVM) |

✖ Levy |

|

✖ Premium Discount Promotion |

|

|

✖ No Claim Premium Discount |

11) How can I make enquiries or lodge complaints?

Customers may make enquiries and lodge complaints directly with us via our customer service hotline at 2533 5555, or through the following channels:

(a) Voluntary Health Insurance Scheme (VHIS) Office implemented by the government of the HKSAR (for issues specific to the VHIS, including product availability, features of Certified Plans and compliance with the Code of Practice for Insurance Companies under the Ambit of the Voluntary Health Insurance Scheme);

(b) Insurance Authority (for issues concerning the general conduct of insurance companies and intermediaries); and

(c) Inland Revenue Department (for issues concerning claims for tax deduction).

Before a dispute is referred to a Hong Kong court, customers may use alternative means of dispute resolution, including but not limited to mediation and adjudication through the Insurance Complaints Bureau, or other means of mediation and arbitration as mutually agreed between Policy Holders and Companies.

1) Does YF Life provide policy migration arrangements? What policies are eligible for migration?

YF Life already conducted a one-off migration arrangement for customers from Apr 1, 2019 to Nov 30, 2020.

Individual Indemnity Hospital Insurance Plan (“IHIP”) policies effective before the implementation of the VHIS (April 1, 2019) were eligible for migration.

The following FAQ are the details of that specific migration:

2) What were the VHIS-Certified Plans which could be migrated?

Both TaxVantage Plus Medical Plan (VHIS Flexi Plan) and TaxVantage Medical Plan (VHIS Standard Plan) were available for migration.

3) What were the underwriting arrangements for migration?

Migration was subject to underwriting factors including insurable interest, health risk, occupational risk, residential risk and lifestyle. Material facts and information on consumers for underwriting purposes include client’s family history, physical history, physical findings, occupation details, place of residence and relationship between Insured and Policy Holder or/and Beneficiary.

4) What happened to my existing IHIP coverage after successful migration?

Upon successful migration to the VHIS Certified Plan, the existing IHIP coverage was terminated.

5) I have exclusions and extra premiums in my existing IHIP policy. Would these be carried forward to the VHIS Certified Plan after migration?

Any benefit exclusions and/or extra premium rate(s), if applicable, under the existing IHIP policy, were applied to the VHIS Certified Plan after migration.

6) Can the No Claim Bonus under my Hospital & Surgical Plus policy be carried forward to the VHIS Certified Plan policy after the Migration?

For Migration from a Hospital & Surgical Plus policy to a TaxVantage Plus Medical Plan (Flexi Plan) policy, the period for which all the requirements for entitlement of No Claim Bonus have been met under the existing Hospital & Surgical Plus policy will be brought forward to the TaxVantage Plus Medical Plan policy for the purpose of calculating no claim premium discount. Any outstanding No Claim Bonus due to the termination of the Hospital & Surgical Plus policy, if any, will be forfeited according to the terms and conditions of No Claim Bonus of the Hospital & Surgical Plus policy.