The YF Life Tax-deductible Duo Helps Middle-aged Plan Retirement and Increases Awareness of Medical Protection among the Young

March 9, 2020

Taxpayers may enjoy tax concession by taking out Qualifying Deferred Annuity Policy (QDAP) and Voluntary Health Insurance Scheme (VHIS) products before the 2019/20 tax assessment year ends this month. With the Covid-19 outbreak, YF Life Insurance International Ltd. (YF Life) is one of the first few insurance companies to roll out remote application services enabling customers to take out QDAP and VHIS products with greater ease.

The launch of the QDAP and VHIS helps raise public awareness of the need for retirement planning and medical protection. Ms. Jeanne Sau, Chief Marketing Officer of YF Life, says, “Hong Kong has the highest life expectancy in the world1 with men living, on average, up to 82.17 years and women even longer, 87.65 years. And in Hong Kong the average retirement age for men and women is 63.4 and 61.7 years2 respectively. In other words, people have to eke out their savings after retirement for 20 to 30 years or even longer. The key to a worry-free retirement life lies in good planning, and making good use of time to accumulate wealth. The average age of customers of YF Life’s QDAP product MY Deferred Annuity (MDA) is 46 years and over 70% of them are aged above 40. Some of those who take out a tax-deductible MDA also own a MY Lifetime Annuity (MLA), which has no limit on the annuity period. As the annuity period of QDAP largely lasts for 10 or 20 years, therefore, MDA and MLA really do complement each other. Customers can rely on MDA to finance their daily expenses for the first 10 to 20 years after retirement, while they leave the cash value of MLA to accumulate in the policy for higher returns. When the MDA annuity period ends, they can seamlessly continue enjoying their worry-free retirement life with the guaranteed lifetime annuity of MLA.”

On VHIS front, Ms. Sau notes that YF Life’s plans have proven popular with the younger age group. Some 63% of customers are aged under 40, a comparatively higher percentage than the market data released earlier by the Food and Health Bureau, citing 50% of those insured with VHIS being aged under 403. Meanwhile, 97% of YF Life’s VHIS customers took out a TaxVantage Plus Medical Plan (Flexi Plan), which has a higher sum insured and wider coverage.

Ms. Sau continues, “Health and wealth are the two main topics in our lives, so we should not delay our financial planning just because of the current epidemic. Customers can now make use of the remote application services to get information on tax-deductible products directly from our insurance consultants over the phone, in the comfort of their own homes. The application process and premium payment can then be completed via digital channels. This arrangement gives customers convenient access to the tax deductions available to them. What’s more, they will also be entitled to a premium discount offer. With our mission of ‘Owning the future’, we are dedicated to helping customers map out a strategy to safeguard their health and wealth.”

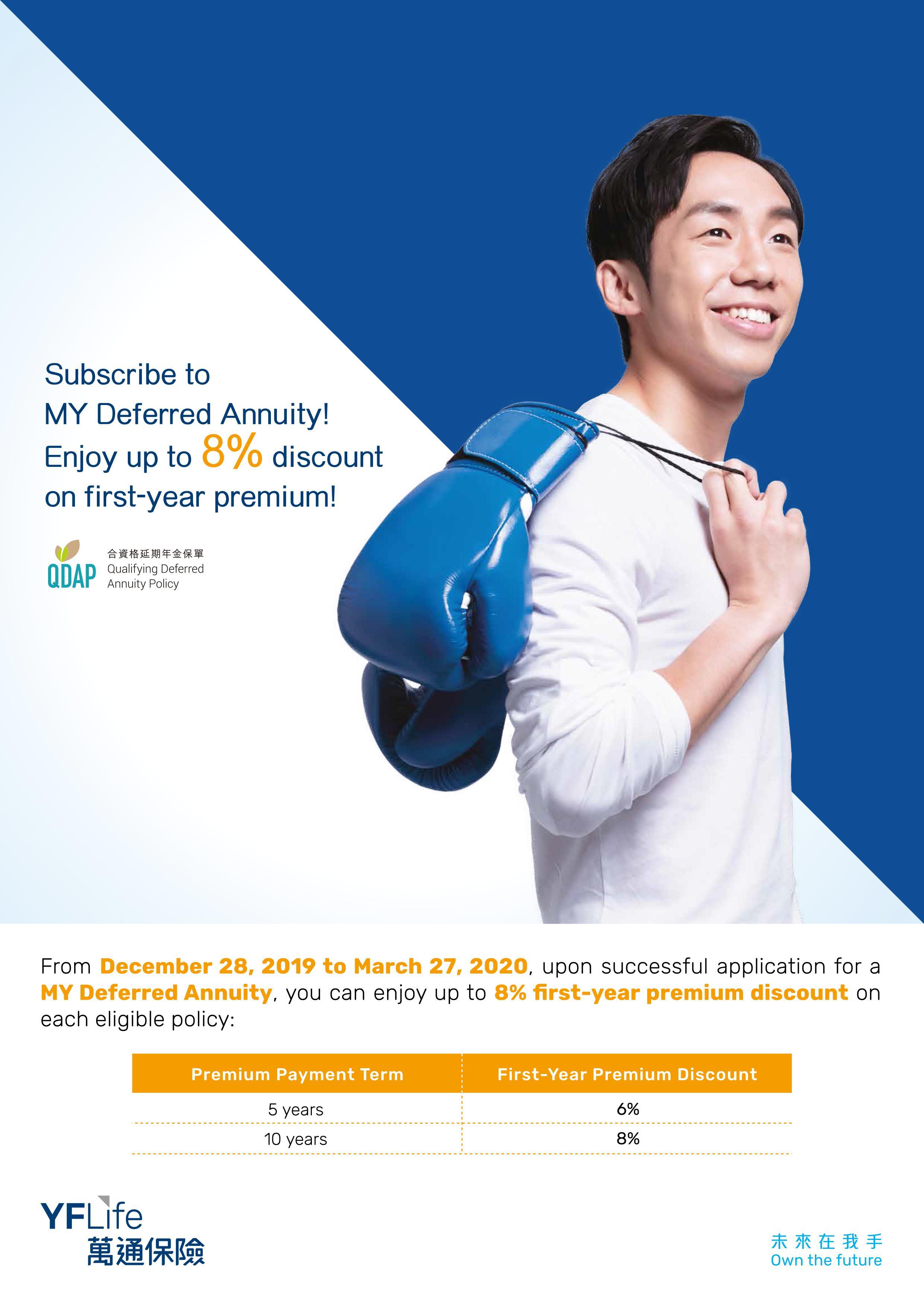

From now until March 31, successful applicants for MY Deferred Annuity can enjoy up to 8% discount on the first-year premium; and successful applicants for TaxVantage Medical Plan/TaxVantage Plus Medical Plan can enjoy a 2-month premium discount. In addition, to offer extra protections to customers against Covid-19, a Free Hospital Income Benefit will be automatically included, upon successful application. With this benefit, upon diagnosis with Covid-19, the insured will be offered daily income of HK$600 during hospitalization, for up to 45 days, with a total benefit of up to $27,000.

YF Life Insurance International Limited is a member of publicly listed Yunfeng Financial Group Limited (HKSE: 376), whose major shareholders include Yunfeng Financial Holdings Limited and MassMutual International LLC. Leveraging our robust financial background and solid reliability, YF Life is committed to helping customers “own the future” by providing professional and technology-enhanced one-stop risk- and wealth-management consulting services, as well as MPF services.

Remark:

1. Statistics released by the Ministry of Health, Labor and Welfare of Japan on 30 July 2019

2. Half-yearly Economic Report 2018 issued by Hong Kong SAR government

3. Press release issued by the Food and Health Bureau on 16 January 2020