Financial Planning

Why joining?

3 Key Benefits

- Career stability

Career development is not hampered by office politics, economic environment, staff lay-offs and salary freezes

- Earnings depend only on individual performance

Earnings and career advancement are 100% controlled by yourself

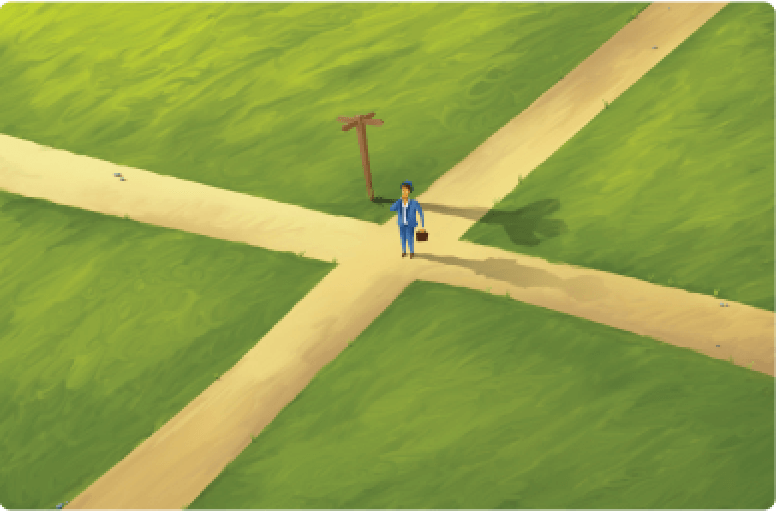

- Independence and autonomy

Working hours, workplace and service targets are all up to you.

3 Key Considerations

- Learn to interact with people

Meeting people is fundamental for the financial-planning career, where there is always the chance of being rejected

- Unbalanced distribution of income

The 80/20 rule is applicable to financial-planning industry: 80% of the income is earned by the top 20% consultants, because top performers are always more persistent.

- Self-discipline and working attitude

The working hours in the financial-planning industry, which are decided by the individual, are more flexible than in other industries. As a result, discipline in working habits and attitude is the crucial factor for being successful in this industry